Level Up Your Finances: Smart Budgeting Tips for Mobile Gamers Using Digital Banks

For the modern gamer, managing finances is no longer just about saving up for a console every few years. The landscape has shifted entirely to a digital-first economy defined by monthly subscriptions, season passes, and in-game microtransactions. To maintain a healthy balance between entertainment and fiscal responsibility, you need a financial command center that operates as smoothly as your gameplay.

Finding a reliable mobile banking app is the first step toward securing your funds while maximizing your gaming budget. Digital-first solutions are designed to match the speed of online life, offering distinct advantages over traditional institutions. Platforms like Roar. bank.in aim to serve digital natives who require instant access to their money without physical branch limitations. It is crucial to understand the structure of these platforms for full transparency: theroarbank. in is not a separate bank, but an initiative of Unity Small Finance Bank Limited. This distinction ensures users understand they are backed by an established banking entity while enjoying a streamlined digital interface.

Integrating Digital Banking into the Gaming Lifestyle

Gamers often require instant liquidity to capitalize on limited-time offers or exclusive drops. Traditional banking, with its set business hours and slower processing times, rarely aligns with the 24/7 nature of online gaming environments. A robust digital banking interface allows for real-time management. When you are tracking expenses across Steam, the PlayStation Store, or mobile app stores, visibility is key. The “Super App” trend in fintech has merged lifestyle management with banking, giving users the ability to check balances, move funds, and audit spending without ever leaving their smartphones or their gaming chairs.

Cutting Costs to Boost Your Gaming Budget

For cost-conscious users, particularly digital natives, fee transparency is a non-negotiable feature. Every dollar spent on monthly maintenance fees or minimum balance penalties is a dollar that cannot be spent on a new title or hardware upgrade. When evaluating a financial tool, look for fee-free structures. High-quality digital banks focus on eliminating administrative costs. By redirecting money saved on banking fees, you effectively increase your disposable income for gaming. Over a year, saving $10 to $15 a month in fees equates to purchasing two or three brand-new triple-A games.

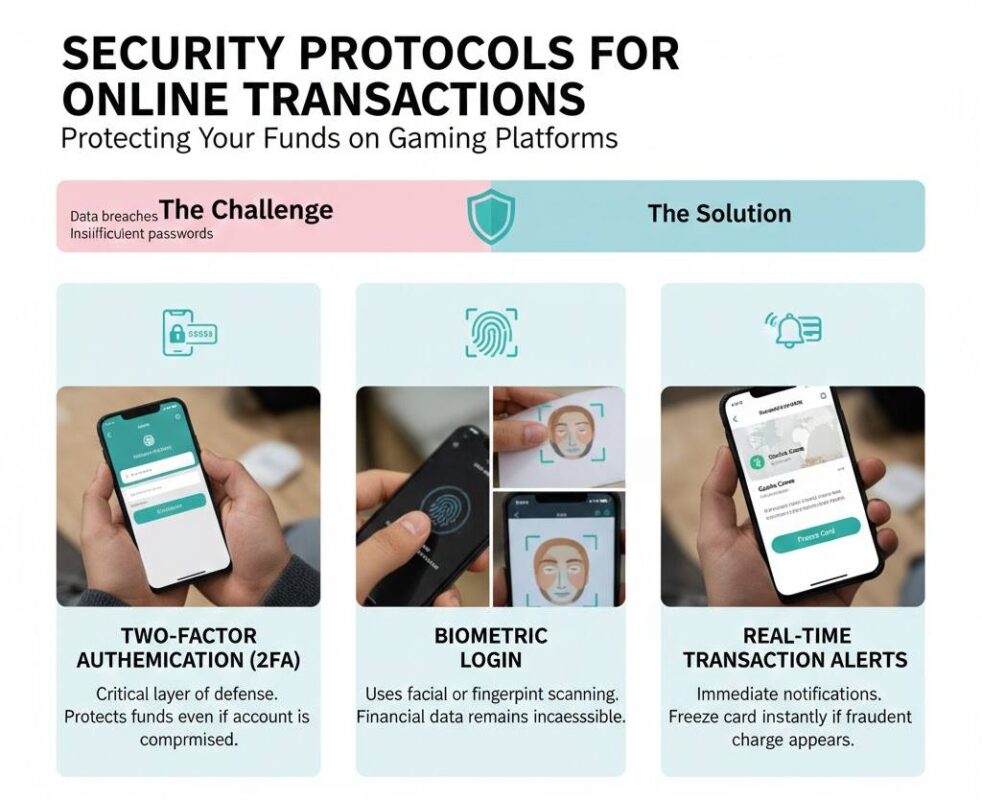

Security Protocols for Online Transactions

Security is the primary trust signal for any user linking their bank account to a third-party gaming platform. In an era where data breaches are common, a standard password is insufficient protection for your hard-earned money. Essential features to look for include:

- Two-Factor Authentication (2FA): This is a critical layer of defense. Even if your gaming account is compromised, 2FA on your banking app ensures unauthorized users cannot drain your funds.

- Biometric Login: Modern apps utilize facial recognition or fingerprint scanning. This ensures that even if you lose your physical device, your financial data remains inaccessible to others.

- Real-Time Transaction Alerts: Immediate notifications are vital. If a fraudulent charge for a “gacha” pull or loot box appears, an instant alert allows you to freeze your card immediately within the app.

Mastering Microtransactions with Budgeting Tools

March and April are often key months for financial planning, making it the perfect time to audit your subscriptions. Many gamers underestimate the cumulative cost of small, recurring purchases. Effective budgeting integration within your financial application allows you to categorize expenses specifically as “Entertainment” or “Gaming.” This visibility helps distinguish between essential spending and hobbyist expenses. Setting a hard cap or using a “virtual envelope” system for gaming expenses ensures you can enjoy your hobby without impacting money set aside for rent or groceries. Audit your current banking tools today; if your app doesn’t offer real-time alerts or spending categorization, switch to a tool that turns banking from a chore into a strategic advantage for your digital lifestyle.

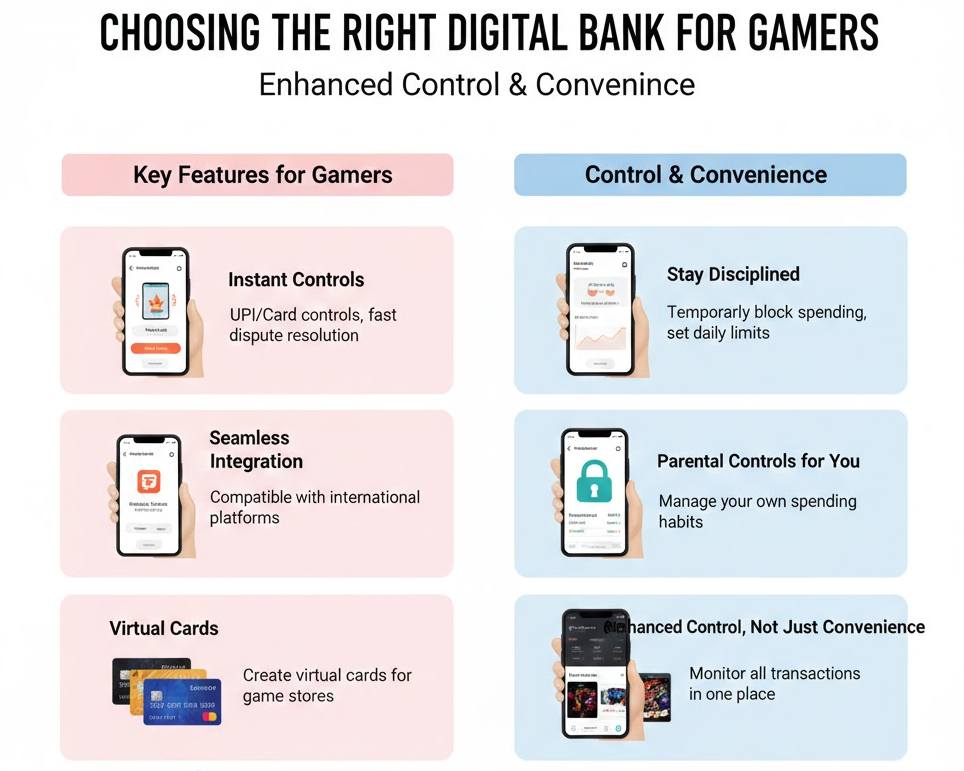

Choosing the Right Digital Bank for Gamers

Not all digital banking apps are built with gamers in mind. Before committing, evaluate whether the platform supports instant UPI/card controls, fast dispute resolution, and seamless integration with international gaming platforms. Look for apps that allow you to create virtual cards for game stores, temporarily block spending, or set daily limits. These features act like parental controls for yourself, helping you stay disciplined without sacrificing convenience. A gamer-friendly bank should enhance control, not just convenience.

Automating Smart Money Habits

Automation is one of the most underrated tools for financial success. Setting up automatic transfers to savings or expense categories right after your salary hits ensures that gaming spends never interfere with essentials. You can also automate reminders for subscription renewals or unused services. By letting the app do the heavy lifting, you reduce impulse spending while still enjoying guilt-free gaming sessions.

Final Conslusion

Gaming is meant to be immersive, exciting, and rewarding, not a source of financial stress. By pairing your gaming lifestyle with a transparent, secure, and feature-rich digital banking solution, you gain complete control over your spending without compromising fun. Treat your finances like a long-term game: track progress, manage resources wisely, and upgrade tools when needed. When your banking works as smoothly as your gameplay, leveling up both your wallet and your entertainment becomes effortless.