What Are Mobile Blockchain Games?

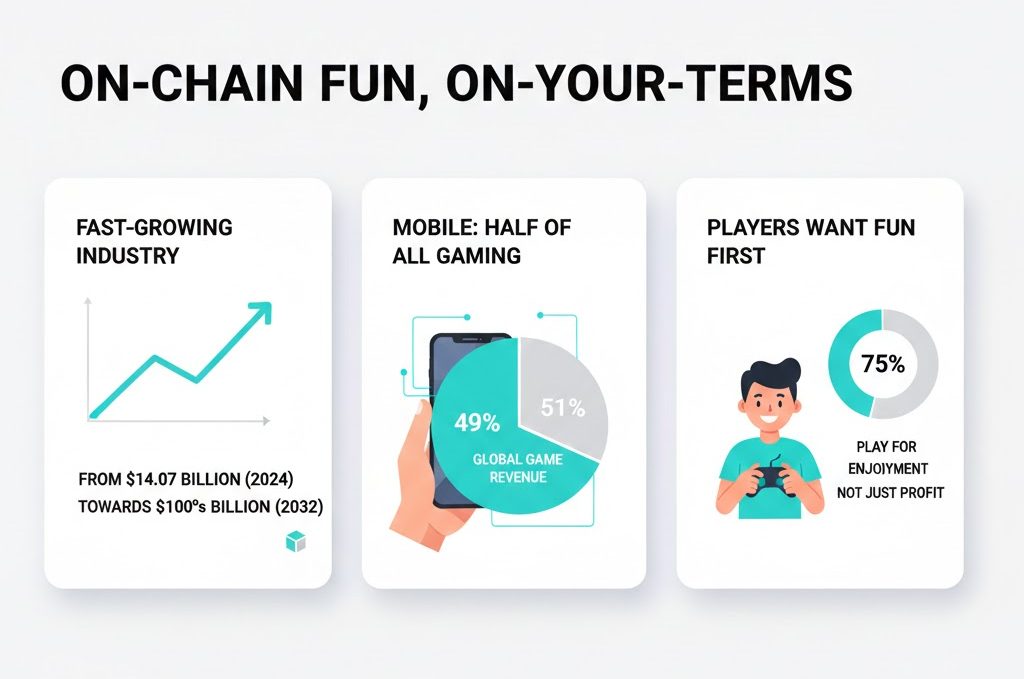

A 2024 industry report estimated that blockchain gaming generated about 14.07 billion USD that year and could grow to roughly 829.02 billion USD by 2032, which implies an annual growth rate of around 66.45% over that period. That forecast tells you this isn’t a side experiment anymore, and a huge part of that growth is expected to meet you where you already play most often: on your phone.

If you’ve ever checked out a major payments-focused cryptocurrency such as XRP, you’ve already seen how blockchain technology is moving into everyday use, and games are one of the most approachable ways to feel that shift on mobile.

This article is here to unpack what that actually means. You’ll see how blockchain games on mobile differ from regular titles, where the real opportunities lie, and how to enjoy them, using only data from independent analysts, regulators and established research teams.

Think of it as a friendly briefing before you tap into your first blockchain-powered game. As Binance Co‑Founder Yi He puts it, “Crypto isn’t just the future of finance – it’s already reshaping the system, one day at a time,” and gaming is one of the places you’re most likely to feel that change on mobile.

Why Mobile Is Ground Zero for Blockchain Gaming

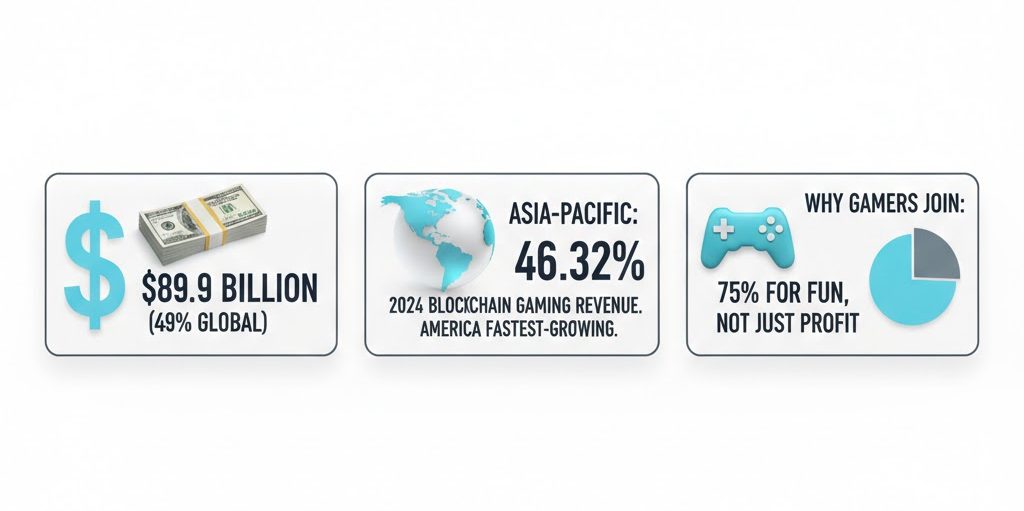

- If you mainly play on your phone, you’re in the majority. Newzoo’s global games market model, cited in a 2024 industry review, estimated mobile game revenues at about 89.9 billion USD in 2023, close to 49% of all game spending worldwide. Nearly half of global game money already flows through smartphones, so it’s no surprise that many blockchain projects see mobile as their natural home.

- On the blockchain-gaming side, a 2024 report from Data Bridge Market Research found that the Asia–Pacific accounted for roughly 46.32% of global blockchain gaming revenue in 2024, with North America highlighted as one of the fastest‑growing regions over the coming years. That matters if you’re in the US, because it suggests more locally relevant titles, better support, and clearer regulation are on the way, rather than this staying a niche corner of the world.

- There’s also a misconception that everyone in “GameFi” only cares about speculation. A survey of 2,428 GameFi investors, summarised by ChainPlay, reported that around 75% said they got involved mainly because they enjoy gaming, not just to chase financial returns. That lines up with a simple truth you probably recognise in yourself: if a game isn’t actually fun, you’re not going to keep opening it, no matter how many tokens it promises.

- Put together, these numbers point to something practical. Mobile is where people already spend their gaming time, and many players stepping into blockchain titles do it for the same reason they try any other game: they want entertainment first, extras second. That’s a healthy mindset to bring with you as you explore this space.

What “On-Chain” Really Means When You Play

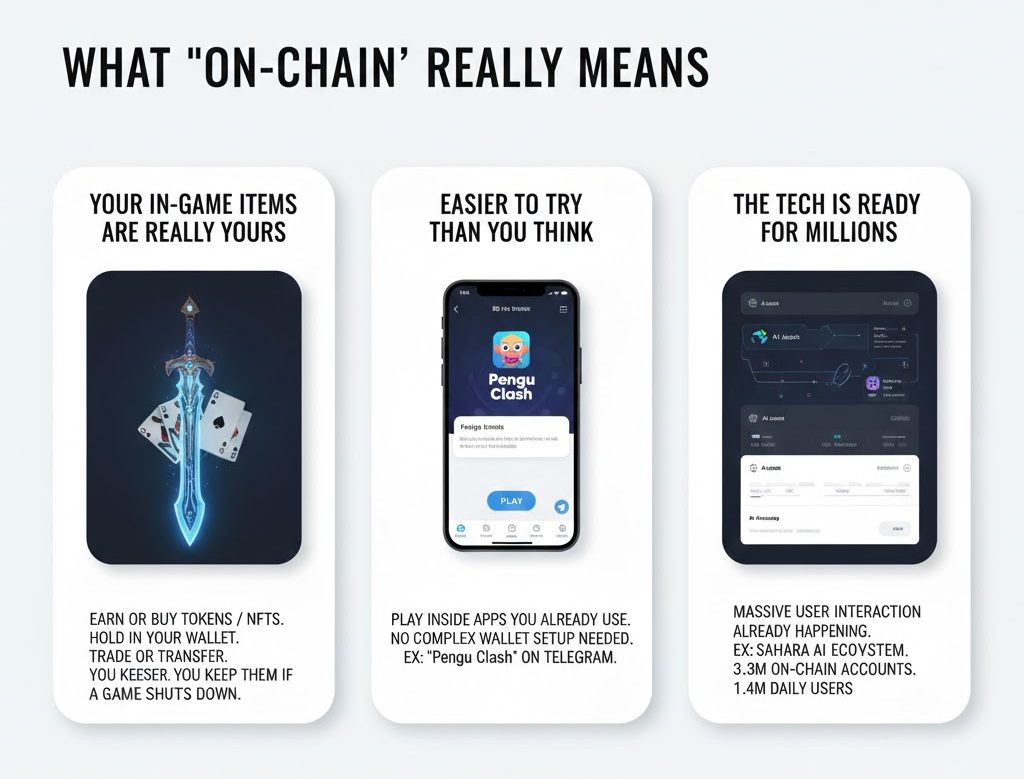

- So what actually changes when a game on your phone is “on-chain”? At a basic level, some of the things you earn or buy in-game, like items or currencies, are recorded on a public blockchain rather than being locked inside a single company’s servers. In practice, that can mean a sword, card, or cosmetic you obtain is represented as a token or NFT that you can hold in a wallet, trade, or sometimes move into another compatible experience, instead of losing it if a game shuts down.

- The space is still young. An annual survey of blockchain game companies reported roughly 2.2 million monthly active users in 2023, down about 15.4% from around 2.6 million the year before, but also noted that many teams expect a meaningful share of the wider games industry to adopt blockchain elements within a year. That combination of modest user counts and strong expectations is typical of a field still working out what “good” looks like.

- You can already see experiments that feel very close to everyday mobile play. Data Bridge’s 2025 update highlights “Pengu Clash,” a blockchain-based multiplayer skill game launched on the TON blockchain and distributed through Telegram, an app with a user base of over 1 billion. Instead of asking you to install a complex wallet first, the game meets you inside a messaging app you might already use, which lowers the barrier for anyone just curious to try it.

- There’s also evidence that on‑chain interaction at scale is no longer theoretical. A Binance Research deep dive into the Sahara AI ecosystem reports around 3.3 million on-chain accounts and roughly 1.4 million daily active users, supported by over 43 million USD in funding and partnerships with major technology organisations. While Sahara focuses on AI assets rather than games, it shows that millions of people can and do interact with blockchain-based applications regularly, often from mobile devices.

- Under the surface, the money rails are maturing as well. Binance Research notes that the USDe stablecoin grew its supply by about 43.5% in August, to around 12.2 billion USD, capturing roughly 4% of the stablecoin market and becoming the fastest stablecoin to pass 10 billion USD in supply, hitting that mark in about 536 days. The same research highlights that DeFi lending total value locked rose about 72% in 2025, with Aave holding around 54% of that segment and Maple and Euler each growing to roughly 3 billion USD.

- For you as a player, this points to an interesting future. Value you earn or spend in a game could, over time, move more freely between titles and services, while the complex parts stay under the hood so you mostly see a smooth mobile experience. The catch is that the more real value flows through these systems, the more important it becomes to know how to protect yourself.

On-Chain Fun, On-Your-Terms

- When you step back, a clear picture starts to form. Analysts see blockchain gaming as a fast-growing part of the industry, from an estimated 14.07 billion USD in 2024 toward a forecast in the hundreds of billions by 2032, while mobile already accounts for close to half of all game revenue worldwide. Industry surveys point to millions of current users, cautious experimentation from developers, and players who still care most about enjoyment, not endless grinding for tokens.

- Looking ahead, it’s easy to imagine blockchain features becoming part of the plumbing behind many mobile experiences, supported by maturing infrastructure such as stablecoins and DeFi protocols that already handle billions in value. The games that thrive may be the ones that feel like the mobile titles you already enjoy, while giving you the option to hold or trade items and currencies on your own terms.

- So as more blockchain-powered games appear in your app store or browser, you don’t need to rush in or sit it out entirely. You can stay curious, lean on the signals regulators and reputable researchers provide, and favour games that put fun first and crypto second. With that mindset, the real question becomes: when blockchain features show up in the games you already love, how much control do you want over what you truly own?

Conclusion

Mobile blockchain games are no longer a fringe experiment. Independent industry data shows a sector that has already crossed into the tens of billions of dollars in annual value and is projected to grow at an extraordinary pace over the next decade. At the same time, mobile gaming already represents nearly half of global gaming revenue, making smartphones the most natural environment for blockchain-based play to mature.

What makes this shift notable is not speculation alone, but accessibility. Blockchain games on mobile are increasingly designed to feel familiar quick sessions, social mechanics, and low-friction onboarding while quietly introducing new ideas around ownership, portability, and player control. Surveys consistently show that most players enter these games for entertainment first, not financial engineering, reinforcing the idea that long-term success will depend on fun, not hype.

The infrastructure supporting this ecosystem is also becoming more robust. Stablecoins, DeFi protocols, and large-scale on-chain platforms are already handling billions of dollars and millions of users, suggesting that blockchain-powered mobile games can rely on systems that are no longer purely experimental. As these technologies fade into the background, players may gain more choice over what they own and how they use it without needing to become crypto experts.

Ultimately, blockchain gaming on mobile is best approached with curiosity and caution. The most meaningful change may not be earning tokens, but having the option to truly own parts of the games you already enjoy. As that option becomes more common, players not platforms will decide how valuable it really is.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, legal, or regulatory advice. Cryptocurrency and blockchain-based games involve risks, including market volatility, regulatory uncertainty, and potential loss of digital assets. Forecasts and growth estimates cited are based on third-party research and represent projections, not guarantees of future performance. Readers should conduct their own research and consider their personal circumstances before engaging with blockchain games, digital assets, or related technologies.

References

Industry Market Forecast (2024)

- Independent blockchain gaming market analysis estimating approximately USD 14.07 billion in 2024 revenue with projected growth to USD 829.02 billion by 2032, implying a CAGR of ~66.45%.

Newzoo – Global Games Market Model (2024 Review)

- Estimated USD 89.9 billion in mobile gaming revenue in 2023, representing roughly 49% of global gaming spend.

Data Bridge Market Research – Blockchain Gaming Market Report (2024–2025)

- Identified Asia–Pacific accounting for ~46.32% of global blockchain gaming revenue, with North America among the fastest-growing regions, and highlighted mobile-first blockchain game distribution trends.

ChainPlay – GameFi Investor Survey (2023–2024)

- Survey of 2,428 GameFi participants reporting that ~75% joined primarily for gaming enjoyment, not financial returns.

Binance Research – Ecosystem & Infrastructure Reports (2024–2025)

- Analysis covering large-scale on-chain usage (millions of active accounts), stablecoin supply growth (including rapid expansion of USDe), and DeFi lending market expansion supporting blockchain-based applications, including gaming.