Are Online Gambling Security Standards Improving Fast Enough?

Online gambling platforms process millions of transactions each day. Each one carries sensitive personal and financial data. The industry has made measurable progress in tightening its security standards over the past several years. Still, the question remains whether those improvements can keep pace with the threats that continue to improve alongside them.

Current State of Online Gambling Security

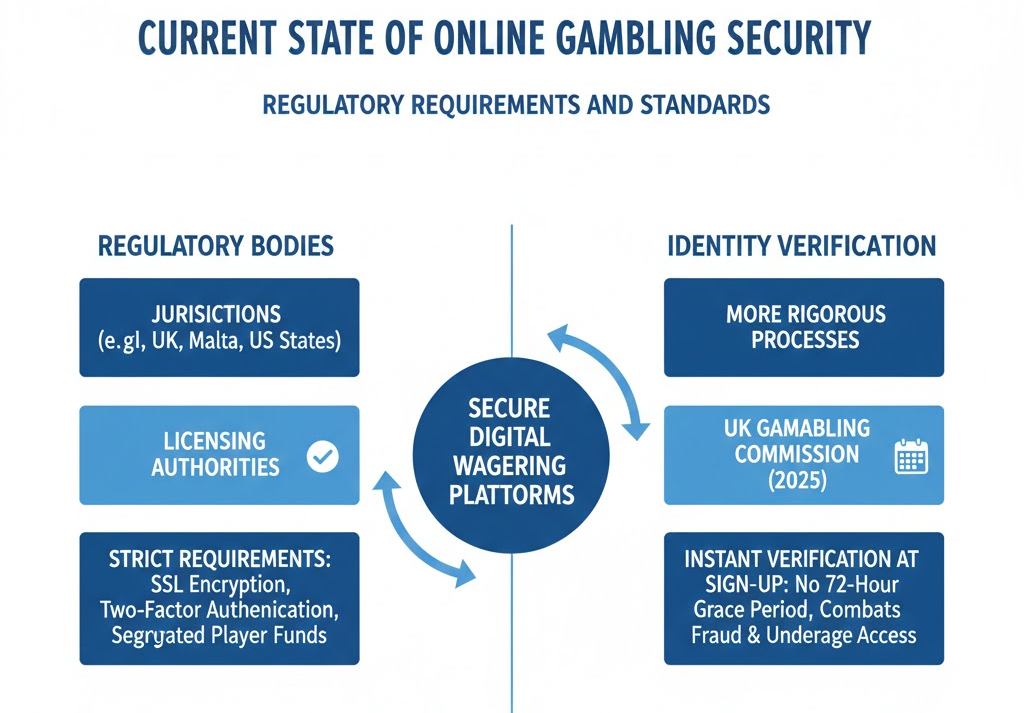

Regulatory bodies across multiple jurisdictions now enforce strict requirements for platform operators. Licensing authorities in regions like the United Kingdom, Malta, and several U.S. states require operators to implement SSL encryption, two-factor authentication, and segregated player funds before they can legally offer services.

Identity verification has also become more rigorous. In 2025, the UK Gambling Commission eliminated the 72-hour grace period that previously allowed players to deposit before completing full identity checks. Operators must now verify a user’s identity and age at sign-up, a shift that directly addresses fraud and underage access.

These requirements form the baseline for what qualifies as secure digital wagering standards across the industry. Platforms that fail to meet them risk losing their licenses and face steep financial penalties.

Encryption, KYC, and Data Protection

Three pillars now define the technical foundation of gambling platform security: encryption protocols, Know Your Customer (KYC) procedures, and data protection compliance.

Modern platforms use 256-bit SSL encryption as a minimum standard. This protects data in transit between users and servers. Payment processing relies on PCI DSS-compliant gateways that add another layer of protection during deposits and withdrawals.

KYC requirements have expanded well beyond simple ID uploads. Operators in regulated markets now conduct financial vulnerability assessments that analyse a player’s income and spending patterns. Anti-money laundering (AML) protocols require operators to flag suspicious transactions and report them to relevant authorities.

Data protection regulations, such as the EU’s General Data Protection Regulation (GDPR), impose additional obligations on how operators store and handle user information. The responsible gaming regulations and statutes guide published by the American Gaming Association outlines how these requirements intersect with responsible gaming frameworks across 38 U.S. states and the District of Columbia.

Where the Gaps Still Exist

Despite this progress, several areas remain vulnerable. Cybercriminals continue to target online gambling platforms specifically because of the high volume of financial transactions they process.

Phishing attacks aimed at player accounts remain a persistent and widespread issue. Attackers often exploit weak password habits and increasingly sophisticated social engineering techniques to gain unauthorised access to user accounts and funds. While many platforms now offer two-factor authentication, it is not universally required across all jurisdictions.

API security is another area of concern. As platforms expand their services through mobile apps and third-party integrations, each new endpoint becomes a potential entry point for attackers. This mirrors a broader trend across the digital world, where modern application security risks continue to grow as digital services expand.

Offshore and unlicensed operators present the largest gap of all. These platforms operate outside regulated frameworks and often lack even basic security protections. Players who use unlicensed sites face significantly higher risks of data breaches, withheld funds, and identity theft.

What Stronger Standards Require Going Forward

Closing the gap between current protections and emerging threats requires action on multiple fronts.

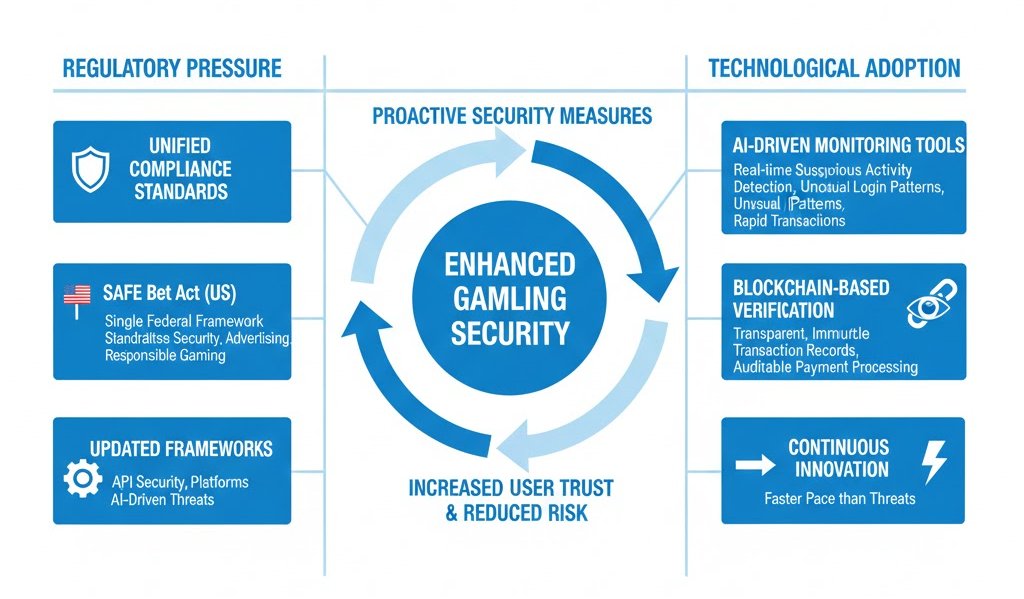

Regulators are already moving in this direction. The newly proposed SAFE Bet Act in the United States aims to establish a single federal framework for online sports betting that would standardise security, advertising, and responsible gaming requirements across states. Whether this legislation passes or not, the discussion signals a broader push toward unified compliance standards.

On the technology side, platforms are beginning to adopt AI-driven monitoring tools that detect suspicious account activity in real time. These systems flag unusual login patterns, rapid deposit-withdrawal cycles, and other behavioural indicators that suggest fraud or account compromise.

Blockchain-based verification systems are also gaining traction among forward-thinking operators. They offer transparent, immutable transaction records that are extremely difficult to alter, adding a valuable auditable layer to payment processing and dispute resolution.

The most effective path forward combines regulatory pressure with technological adoption. Operators that invest in proactive security measures build stronger user trust and reduce their exposure to enforcement actions. Regulators that update their frameworks to address API security, offshore platform proliferation, and AI-driven threats position their markets for more sustainable growth.

Online gambling security has improved. The encryption standards, identity verification protocols, and regulatory oversight in place today are significantly more robust than what existed five years ago. The challenge is that threats change at least as fast as the defences built to counter them. Progress is real, but the pace still needs to accelerate further across the industry.

Conclusion

Online gambling security has unquestionably improved over the past five years. Encryption standards are stronger, identity verification is faster and more thorough, and regulatory oversight has become more structured across major jurisdictions.

However, cyber threats evolve continuously, and gaps remain particularly in offshore markets, third-party integrations, and user-side vulnerabilities. Security progress is real, but maintaining safe digital wagering environments will require faster regulatory harmonisation, wider adoption of mandatory authentication, and continued investment in AI-driven fraud detection.

In short, the industry is moving in the right direction, but staying ahead of increasingly sophisticated cyber risks will demand constant upgrades rather than periodic improvements.

Disclaimer

This article is provided for informational and educational purposes only and does not constitute legal, financial, cybersecurity, or gambling advice. Security standards, regulatory requirements, and platform protections vary by jurisdiction and operator. Users should independently verify the licensing status and security measures of any gambling platform before registering or making financial transactions. Always engage in online gambling responsibly and in accordance with local laws.